What is VAT Exemption / Relief?

Put simply, VAT exemption allows chronically sick or disabled people to buy eligible items at 0% VAT rather than 20% VAT saving them a significant amount of money.

Not all products are eligible for VAT relief such as Batteries , so we are obliged to charge VAT at the prevailing rate for those products that are not VAT exempt.

The Item I’m Buying Is For Someone Else.

If you’re buying something on behalf of someone else, simply add their details instead of your own.

Who is eligible for VAT relief?

To be eligible for VAT relief the government says you have to fit the following criteria:

A person is 'chronically sick or disabled' if he/she is a person:

1. With a physical or mental impairment which has a long-term and substantial adverse effect upon his/her ability to carry out everyday activities; with a condition which the medical profession treats as a chronic sickness, such as diabetes; or

2. Who is terminally ill.

IMPORTANT NOTE: It does NOT include a frail elderly person who is otherwise able-bodied or any person who is only temporarily disabled or incapacitated with a temporary disability . .

What proof do we need to provide?

None. The government requires only a simple declaration about your disability at the time of ordering. No proof of your disability need be shown to any party at any time.

How Do I Claim The VAT Discount?

All we need is the name, address & disability of the person the item is for & what their chronic sickness or disability is. We don't need a doctor's letter or any reference numbers.

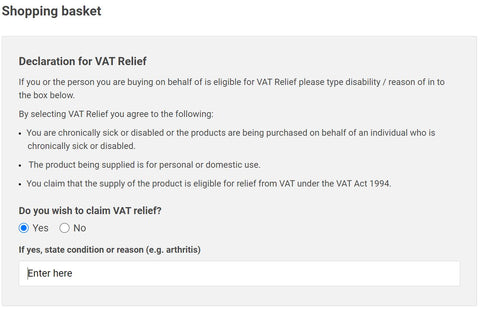

What Do I Do At The Checkout?

VAT exemption is declared in the checkout form. The checkout enables the vat exemption to be requested.

Which Items are eligible?

VAT Exemption only applies to certain items; these are items which have been designed to be used by someone who is chronically sick or disabled. Examples of such products are Mobility Scooters, Wheelchairs, Bath Lifts & many more daily living aids.

Not all products are eligible for VAT relief such as Batteries , so we are obliged to charge VAT at the prevailing rate for those products that are not VAT exempt.